Cicero I. LIMBEREA

Abstract. This paper aims to prove that in countries with no inter-zonal real estate divergence caused by lack of uniform economic development, labor migration trends or other causes, the real estate price movements tend to be correlated with currency movements, thus a certain vulnerability to hot money exists however it may be manageable.

Globalization, the important phenomenon of the late XXth century which advocates free movement of capital internationally as well as free trade, generally allocates risk capital into 3 classes: direct investment, stock market investment and real estate investment.

Direct investment, is prone to follow cheap labor and low corporate tax rates: recent outsourcing trends show that India, China and Eastern Europe, all large beneficiaries of the outsourcing process, are all countries that provide less expensive, educated labor and competitive tax rates.

Outsourcing generates global deflation and immediate domestic deflation since decisions to outsource are made in principal on domestic estimated demand rather than on export plans (Source: of 50 officers of US companies that answered yes to outsourcing on a Labor Department questionnaire who were polled, 38 had no export plans).

For developed countries, if we assume that at the limit, over a large period of time, all M&A deals will lead to oligopoly, achieve pricing power and ultimately lead to price increases, outsourcing is a countering phenomenon if all domestic labor force can be reallocated, since it offers a competitive opportunity to lower prices and keep the same margins since cost is lower, creating a positive supply shock (see graph).

Outsourcing as a percentage of GDP kept a constant mean and has reached double digit levels between 1997 and 2007 in countries such as Bulgaria and Romania, as well as strong 1 digit numbers in countries such as China and India (source Bloomberg).

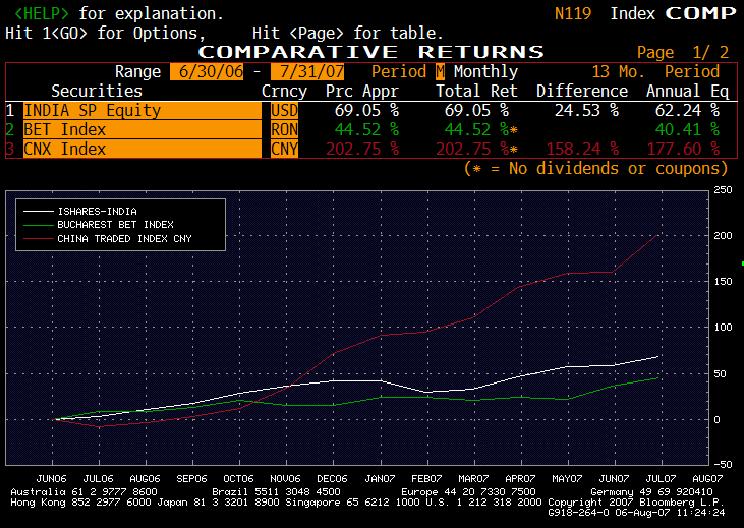

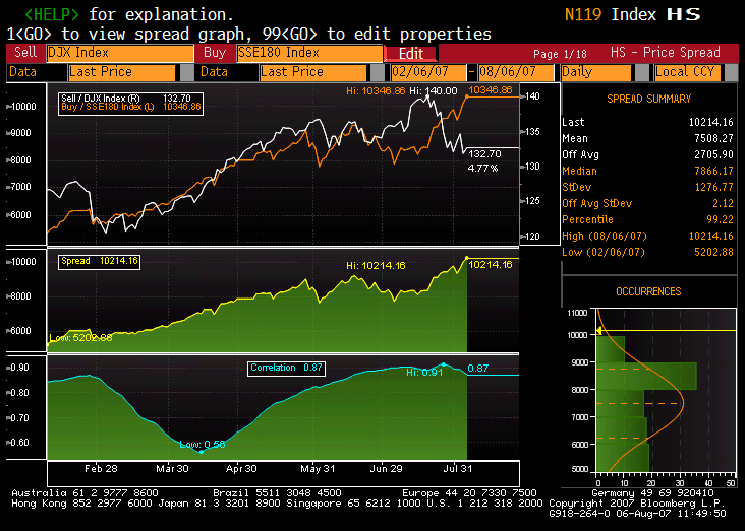

The stock market investment decision rests on diversification and growth. In the era of outsourcing and free capital movement, growth is linked to skilled labor and mobility, thus direct investment should relate to stock market returns. This hypothesis is proven by the spectacular ascent of stock markets in the beneficiaries of outsourcing – see attached stats for China, India and Romania.

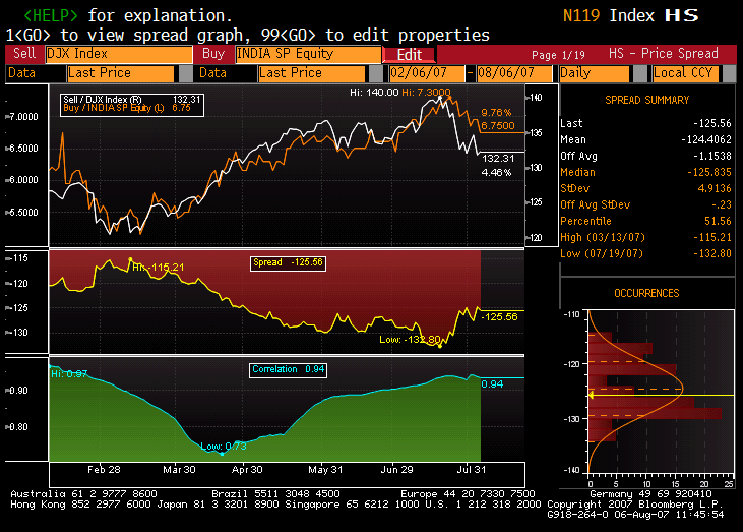

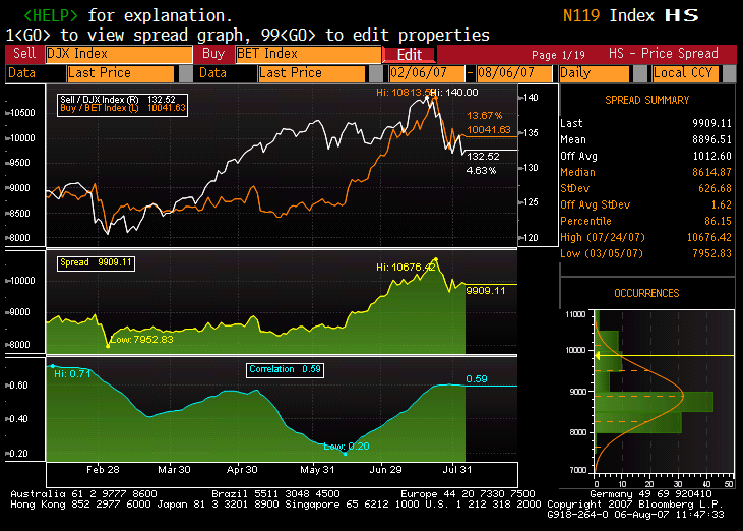

The increased integration of the stock markets between developed and developing countries is a recent phenomenon whose origin we think also to be globalization. Recent reversal of historical negative correlations between emerging markets stock market performance and the mature stock exchanges shown in the 60s and the 70s can be explained by the fact that in the globalization post cold-war era of no tariffs and low transportation costs, direct investment will find global opportunities, leading to global industrial competition given that no insulated demand pockets exist. Therefore diversification between the emerging markets stock market investments and the more mature markets is no longer justified by a negative correlation coefficient between their performances (see following graphs where recent correlation between Dow Jones and the India, China and Romania Stock Exchange indexes is strongly positive).

The link between direct investment, outsourcing and stock market returns is strong since the utilization of production factors can be geographically chosen selectively:

Since production can be achieved with a certain ratio of labor to capital, and for countries with no capital flow restrictions, capital does not get more expensive in a country or other as at least multinational corporations can engage in carry trades and borrow capital in the least expensive place (see recent carry trades done out of Japan), the skill and cost of the labor market would be the main driver of the reason to invest or move production if corporate tax would be equalized across vast zones. This because the cost of the steady-state labor ratio as defined by the Solow-Swan neoclassical growth model can be reduced by less expensive steady-state labor, therefore providing an incentive to invest, and decreasing the capital intensity. Thus the “required” growth rate of capital to keep the capital-labor ratio steady gKr = (dK/dt)/K = n is less than in mature economies. Some food for thought thus exists why Japan was left with negative interest rates for a long time during the 1990s depression all else equal, since the capital surplus did not evaporate due to the availability of lower cost labor zones such as the outsourcing beneficiaries, thus the interest rate has not been bid up for a long time.

A legitimate question thus emerges whether real estate investment is a distinct, uncorrelated asset class.

Real estate investment is also dependent on the 2 factors mentioned above, diversification and growth. Once the investment is made, real estate investors would compare their investments with the historical stock market returns. An intuitive benchmark for comparison purposes would be the historical 7% US expectation.

We are arguing that real estate investors beyond their first home would enter the investment if a 7% per year cumulative return exists and would attempt to exit their investment if the 7% expectation is not met.

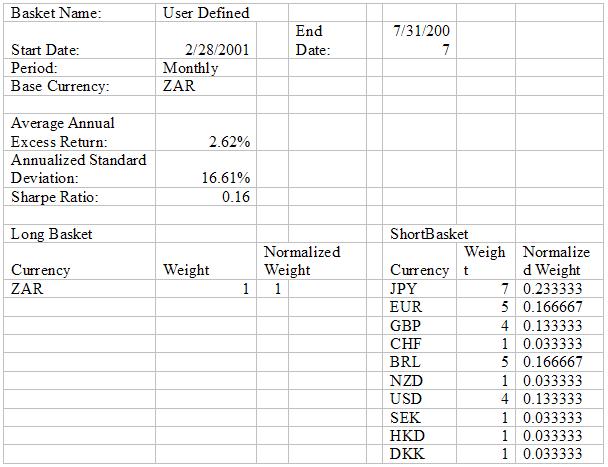

Let’s suppose that this investment decision would be unchanged if the exchange rate of the currency of the country in which the investment will take place belongs to a country that has not had a currency shock for the past 5 years and which has not had yearly depreciation of more than 10% in the past 1 year against a trade-weighted basket of international currencies, thus allowing the real estate investment to act as a natural hedge against currency depreciation.

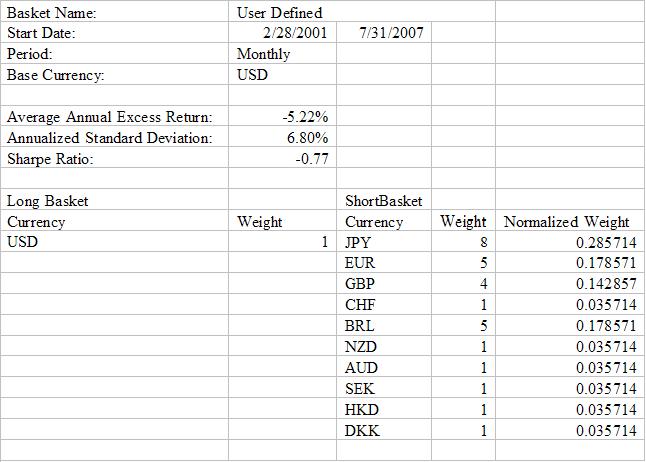

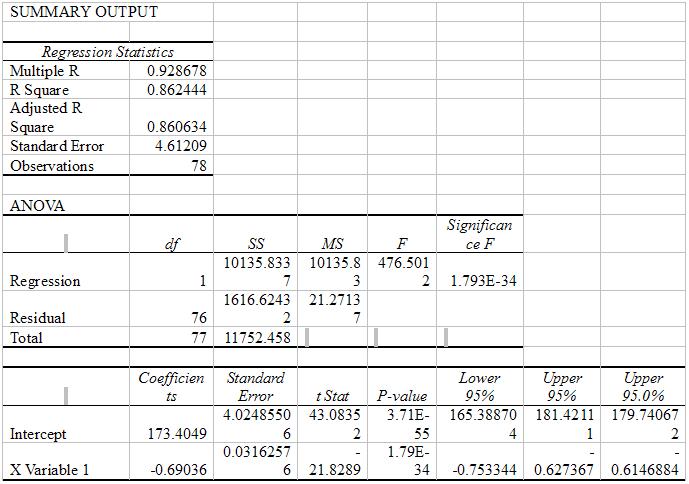

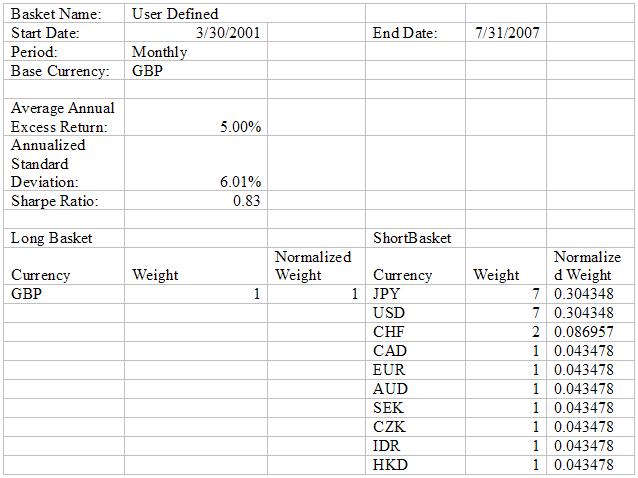

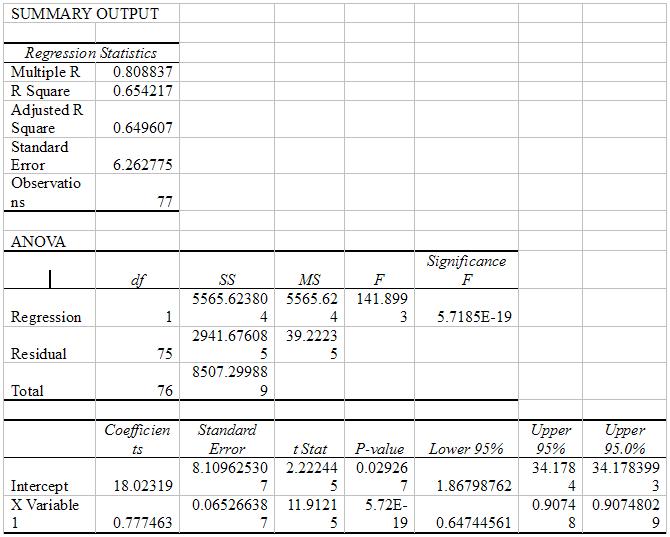

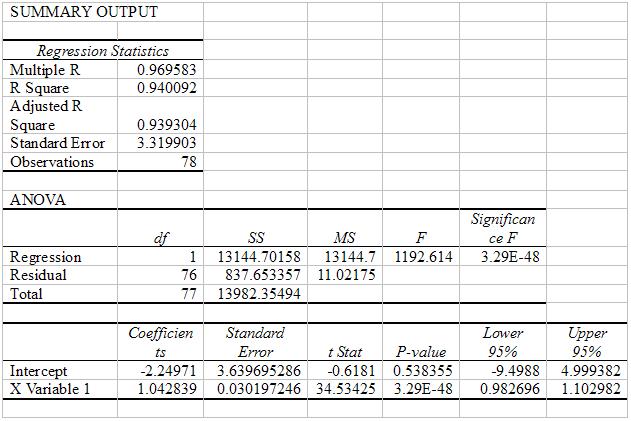

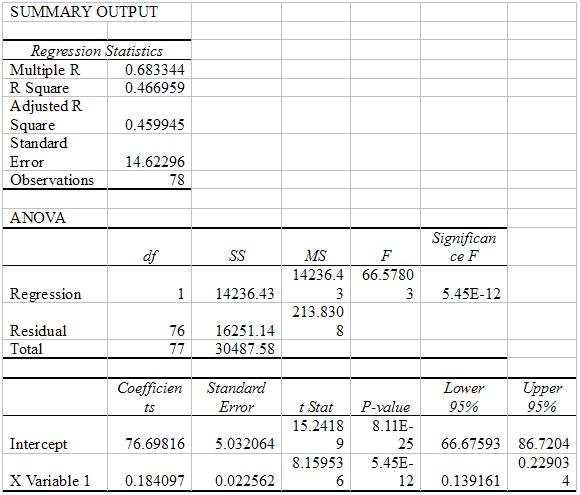

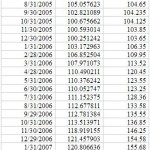

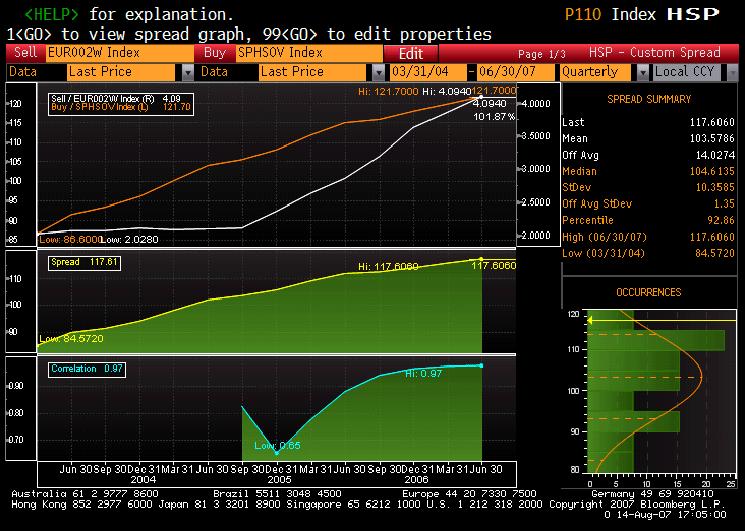

For the US, UK, Australia, South Africa and Romania, we regress on a monthly basis the yearly cumulative difference between the appreciation of the domestic housing market index as calculated by the national housing regulator and the 7% stock market yearly return expectation, against the monthly change of the domestic exchange rate against a foreign trade-weighted basket of currencies. We normalize the starting point for the 2 data sets at 100.

Δ FX = a + b Δ (House Index – 7%/12) + ε

For all 5 regressions, an Rsq and t-stat nil hypothesis rejection shows that the link between house prices and exchage rate trends is strong and cannot be ignored.

For the countries with floating exchange rate regimes, USA, UK and Australia, the slope is higher, thus a higher percentage of the exchange rate volatility is explained by house price movements. For the countries with fixed exchange rate regimes, Romania and South Africa, the slope is lower.

The US example seems to suggest that the unwinding of the perceived real estate bubble is associated with devaluation. However the annualized negative trend of the USD against the trade-weighted basket of currencies is still within the annual negative 10% band as we assumed apriori. A further analysis (see last 5 data points) after the subprime mortgage crisis shows that investors exiting the real estate market are causing a more severe depreciation, although more severe expectations are contained since the subprime MBS recent crisis has been pinpointed to only the subprime sector and contagion to the higher MBS tranches has not occurred (source: US Treasury, 2007). The negative slope shows that the real estate market investments in the US are hedges to the US dollar. However since the US benefits from abundant internal capital due to high stock market PER multipliers besides a positive capital account, notwithstanding the balance of payments deficit, a vulnerability to hot money does not exist. Thus people trying to diversify their holdings are investing in the real estate market and the real estate market still benefits from allocations out of a pure diversification reason.

For all other countries examined, except the EU, the slope of the regressions is positive thus large capital inflows or outflows can cause perturbations.

The UK example with the lower Rsq below but high positive slope seems to suggest that the recent appreciation of the pound is faster than the growth of the real estate index and investors are not entering anticipating a bubble in the real state market, consistent with current specialist opinions and waiting for a correction level associated with the bubble break. The Bank of England has kept high interest rates throughout the measurement period. This weaker Rsq has been expected since the UK real estate market has been perceived by many analysts to be in a bubble. It would be interesting to monitor in future if a downturn in the strength of the pound would induce the unwinding of the bubble, or a more mild reversal of the index.

The Australian and Romanian examples are strong and show strong currency appreciation partly induced by strong performance of real estate investments and continued real estate investments induced by expected continuing strong real estate performance.

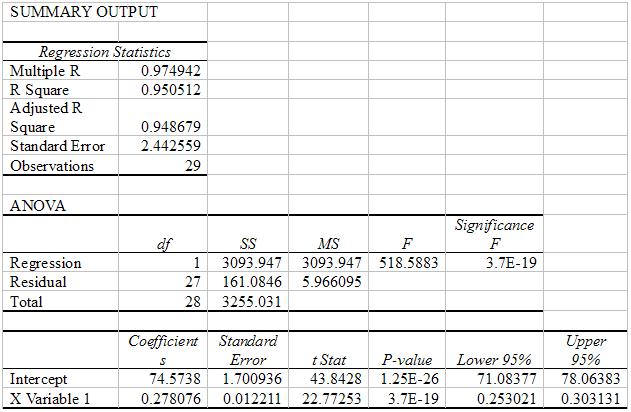

The UE case:

In Spain the CPI fell below the ECB refinancing rate prior to the adoption of the Euro. Thus the country met the Maastricht criteria and could adhere to the Euro. Post adoption, due to the sudden high investment, the CPI index rose above the EU average refinancing rate, which induced self perpetuating higher inflation than in the rest of the Euro zone until Spain adopted a direct inflation targeting and its CPI was driven below the ECB refinancing rate. During this time, the Spain real estate displayed strong growth (see graph), having been correlated with the Spain CPI index and the refinancing rate in Euro zone.

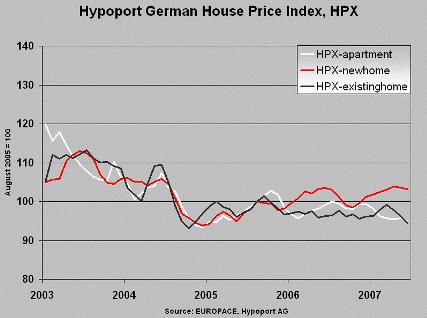

At the same time the real estate index in other EU countries, such as Germany (see graph) turned negative.

Thus because of the lack of concerted correlation between real estate indexes in EU members, a calculation of the overall influence of the real estate market against the Euro would not be pertinent. Thus for the Euro zone the real estate analytics should be drilled down to individual countries. The euro appears to be an export-driven currency, in which the budget/ capital account fundamentals have a higher bearing on the direction of the currency, allowing the Euro zone to be able to cushion hot money without high currency moves.

BIBLIOGRAPHY

1. Calvo, G., and Reinhart, C. (2002). „Fear of Floating.” Quarterly Journal of Economics, 177: 379-408.

2. Levy-Yeyati, E. and F. Sturzenegger (2004). „Classifying Exchange Rate Regimes: Deeds vs. Words.” European Economic Review.